Disclaimer

AmadeusValue is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Introduction

This is a continuation of my Part 1 published yesterday. The only stock I wrote up on Substack in 2024 - Aclaris Therapeutics ($ACRS) - rose +350% at it’s peak (unfortunately I only captured a portion of this upside). Hopefully some subs benefitted from this as well.

To stop the length of this post getting too long, it is likely I write a Part 3 detailing the other stocks I think are interesting going into 2025.

As a reminder - my investment approach is to look for equity ideas that fall under either the ‘special situation’ category, or compounders that exhibit the following characteristics:

An entry equity free cash flow of >7% (which can be reduced to the >5% range when assessing higher-quality than average companies)

The logic behind this is that in the case said business can no longer grow at GDP+ or goes completely ex-growth, it could instead revert to a 100% dividend pay-out ratio which would result in a 5-7% dividend yield and thus would be attractive in itself vs. the US one-year T-Bills are currently at ~4.16%. This criterion forms a key element of downside protection.

Qualitative aspects that mean it is reasonable to be able to estimate what equity free cash flow per share could look like over the next five years

This includes a solid competitive moat (which is ideally expanding), recurring revenue, a stable or improving industry structure etc. This should also mean that the exit multiple I assume is not too far off what I enter at given hopefully minimal concerns regarding terminal value.

>7% equity free cash per share growth, which when underpinned by the two above points, should mean underwritten IRR’s of 15% p.a. over a five to ten year period (>7% eFCF yield + >7% eFCFPS growth).

Ideally this is underpinned by a sustainable secular tailwind which can underpin revenue growth assumptions.

Regarding equity allocation, there seems to be a general consensus forming that allocating more capital towards equities, gold and hard assets, despite frothy valuations, is a safer bet than retaining cash knowing on a real basis that the value of your cash is falling ~5% a year due to on-going monetary debasement.

As anyone who has studied economic history knows - when there is a bi-partisan (or unilateral in the case of historic emperors / monarchs!) reluctance to preserve the value of fiat, monetary inflation can become exponential and thus the owners of hard-to-replace assets become the only ones that retain their wealth in real terms (Weimer Germany being the extreme example!)

Thus - given this worldview, I have decided over the past year significantly increased my allocation to equities, particularly those that I believe should fare okay in an inflationary environment.

Key current stocks in my portfolio are below - whilst my previous post mentioned that going forward, new ideas will likely be US tech large / mega cap, there is still a tail of small / mid-caps that I am interested in and believe are worth posting about.

In the spirit of conciseness - I have kept the write-ups brief. If you would like to discuss any stock, please reach out.

BFF Group ($BFF.IM) - €1.7b market cap - compounder

BFF is an Italian headquartered and listed bank focused primarily on factoring receivables owed to large pharmaceutical customers (i.e. Merck, Johnson & Johnson), by Southern European public administrative entities (i.e. Italy, Spain, Portugal).

The business began in 1985 w/ equity of €260k. Since then, with no further equity raised, it has generated €1.1b in dividends and is capped at €1.7b. A 26% IRR over 38 years.

The thesis from here is that:

On conservative estimates, BFF is on a FY25/26e PE of 9.5x and 8.3x respectively. Given the 100% dividend pay-out policy over a 12% CET1 ratio (c12.3%), this equates to a FY25/26e 11% and 12.7% dividend yield respectively

The Bank of Italy (hopefully) lifts the dividend payment ban which resulted from a finding during an routine inspection in early 2024 and;

The company returns to growing NPAT 10-15% per year (the lower end of FY26e guidance laid out at the FY23 CMD) which would drive 15-20% IRR’s. The CEO owns 5% of the biz, and is one of the sharpest operators I’ve ever encountered (check his CV !) so I believe he has minimal incentive to lay out targets that could be missed significantly.

The business model is essentially an arbitrage between the low-cost funding rate from the float of its Payments and Securities Services division (c3.72%) and the higher gross yield of its factoring book (c7.1%). Given c95% of the factoring book is towards Public Administration entities which technically cannot go bankrupt (government commercial debt is a higher lien than sovereign debt), BFF employs >10x leverage on its book to deliver consistent >30% RoE’s.

Additionally, Factoring penetration is only at 15-20% in BFF’s key markets suggesting a decent growth runway ahead.

CY/FY2024 was an annus horribilis for BFF. In 1Q24, the company announced an investigation from the Bank of Italy regarding its method of accounting for past due loans, which resulted in a still on-going dividend payment ban.

This investigation had the impact of slowing factoring volume generation in Italy due to RWA contagion and this has also scared away the many income investors in the stock. I believe there is a significant catalyst in the BoI lifting this dividend payment restriction in February 2025 as this would follow the reporting of two quarters since the company has updated its accounting methods for past due loans in line with BoI guidance. This is in line with soft management guidance.

The company states the reason they didn’t correctly prudentially classify these past-due loans was because they went with the direct guidance from the ECB on how to do this instead of the Bank of Italy’s nation-level subjective interpretation of this. The fact that the other main player in the space, Banca Sistema, made a similar mistake indicates this was not a BFF-specific error.

Additionally, there are two potential upcoming positive regulatory changes coming up over the next two years – one on increasing the amount of ‘Late Payment Interest’ and ‘Recovery Rights’ that BFF can collect from debtors, and another on easing the prudential classification of past due loans, which would free up substantial capital.

Whilst waiting for this, you are getting paid a double-digit dividend yield (pre-Italian dividend withholding tax), the company hopefully continues to win more low-cost float through winning tenders in its Security Services division and the back-book of problematic loans gets reduced, freeing up capital for dividends and potentially M&A.

Risks include increased bank taxation from the Italian government, a delay in lifting the dividend ban and any adverse regulation / inspections.

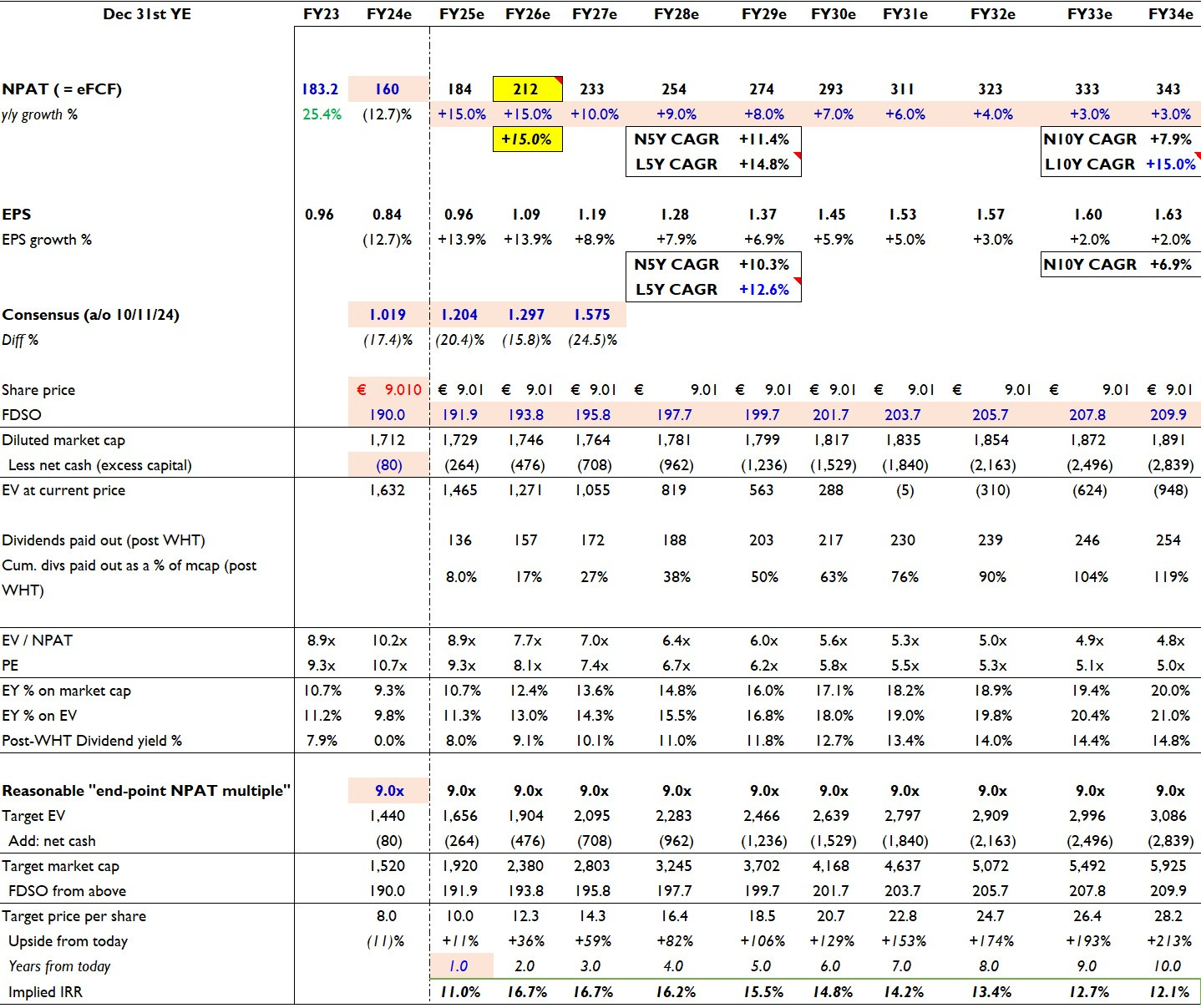

My simple 10-year IRR table on conservative assumptions are below. Note I am forecasting an EPS CAGR of +7% of the next ten years vs. +14% delivered over the last ten years (albeit this includes three M&A transactions). Five-year IRR’s of 15% look achievable on this basis.

Sesa SpA ($SES.IM) - €960m market cap - compounder

Sesa is an Italian IT service business, owned c53% by its founders. The business derives >90% of revenue from Italy, and is essentially a play on Italy’s current under-indexation of IT spend to GDP eventually catching up to Western Europe (currently ~3% vs. >5% for the rest of Europe).

It has three segments:

Computergross (Value Added Sales): This is distributing hardware and software from tech OEM’s to domestic value-added re-sellers

VARGroup (Software System Integration): This is selling hardware, software and services directly to domestic small and medium sized businesses

Business Services: This is selling Vertical Market Software and consulting services to small and medium sized businesses (unsurprisingly this segment has the highest margin and growth potential).

Similarly to BFF, 2024 was not a great year for various reasons. But, the thesis from this price does look superbly compelling (assuming no more management mishaps):

The temporary pressures seen in 1H25e such as higher interest costs than expected, the fall-out of Digital Value’s bribery case hitting VAS revenue, elevated working capital, lower margins (headcount growth now slowing) and growth headwinds in Digital Green will likely reverse / stabilize in 2H25e (helped by much easier comps)

It is currently trading at the cheapest multiple since IPO - a FY25e (April YE) ~9% eFCF yield / 9x PE.

Higher margin segments SSI and BS continues to grow in mix, leading to a structural improvement in growth and returns (lower capital intensity and higher margins).

This is a medium quality business - ComputerGross is the dominant VAD biz in Italy, whilst SSI and BS are strong challengers respectively.

There is also optionality in BS segment eventually being spun out at 12-15x EBITDA (50% of sales here are from vertical market software) in line with listed Italian peer Sys-Dat. This is a 24% incremental EBITDA margin business growing 10-15% organically with a very long inorganic growth runway.

Primary risks are:

Continued economic weakness in Italy depressing SME IT demand

Continued vendor consolidation (i.e. Splunk / Cisco, Juniper / HPE)

Worse rebate terms (i.e. Microsoft, Cisco, VMWare)

Lower device counts structurally reducing VAS demand.

Candidly, management’s credibility has been hit from missing guidance for the past three quarters, plus I do not like the language focus on EBITDA vs. NPAT / eFCF.

Below is an outline of forward valuation multiples based on conservative assumptions, along with a rough SoTP. Note I include factoring debt in my EV calc.

Nissan Tokyo Sales Holdings ($8291.JP) - $220m USD market cap - special situation

NTH is the primary Nissan dealership within the Tokyo area - it sells 85-100k new cars per year and repairs ~600k cars annually via 125 dealerships. It makes the majority of its margin via the repair portion of the business, hence it is a very steady-eddie business (it has earned ~150b yen of sales annually on average for the last ten years).

Nissan (the listed OEM) still retains a 35% stake in the business.

The thesis is predicated on:

Real book value being closer 1,200 yen per share (vs. a 520 yen share price) when adjusting land value to market (vs. it being recorded at cost). Excess cash is 60% of the market cap. The current zeitgeist in corporate Japan continues to push companies to reduce the gap between market price and book value via boosting ROE’s

The company has started to buyback shares for the first time ever. It bought back 11% in one day a couple of weeks ago to help clean up the overhang of insurance co’s that collectively owned 21% of the float.

Increased liquidity could spur the entry of an activist to force the company to return more cash or monetise it’s vast land holdings via a sale and leaseback

Maths below:

Currently, Nissan and Honda are angling towards a merger by CY2026, with Mitsubishi potentially being included to create a Japanese super-OEM to defend against the Chinese EV threat, whilst essentially bailing out Nissan.

There is a chance Nissan in-houses its existing listed subs / they decide to monetise this via a MBO. It is worth noting that Honda - the entity who will ultimately control Nissan - acquired the minority shares in three of their largest subs - Keihin, Showa, and Nissin Kogyo - back in 2020, before merging it with a number of other part-makers to become Hitachi Astemo in 2021

Risks: Lower yen increases cost of foreign sourced auto parts, accelerated deterioration in Nissan’s financials, inertia by Nissan to create value at NTH (its 35% stake blocks any external attempt here to accrete value)

Comms Group ($CCG.AX) - $32m AUD market cap - compounder

I wrote up Comms Group initially in February 2022:

There have been significant changes to the business since then. My initial thesis was that CCG could be a consolidator of Aus-based SME telco / IT service names over the next three years. For various reasons this did not eventuate.

Instead - I believe I have stumbled across a hidden growth gem in CCG’s Global division. This involves hosting the back-end for ‘Microsoft Teams Calling’ deployments by global telco’s like Vodafone Enterprise and Tata. This is a 50% EBITDA margin business for Comms, and is ramping up rapidly.

From here, the stock at 8.1c is on a fully diluted market cap of $31m. $4m of net debt = $35m EV. The business generated $2.7m of real equity free cash flow last year which equates to a trailing eFCF yield of 8.7%

There was $1m of "one-off" expenses (adviser fees) in FY24 that won't re-occur given the Strategic Review the company had launched has finished.

Assuming +5% organic revenue growth this year (very conservative when considering the recently announced Global deal on 9/09/24 for $2.4m over three years which should be at a ~50% EBITDA margin - so $400k per year of EBITDA roughly notwithstanding further wins here), the strongish Aussie macro, industry tailwinds and a flat EBITDA margin gets you to ~$7m EBITDA for FY25e.

That would means roughly ~$4m of equity free cash flow for FY25e. That is a 13% equity free cash flow yield for a business with a clean balance sheet and great organic growth prospects. With that cash they will continue to pay down debt, and fund its recently announced dividend which is running at a fully-franked 3% dividend yield currently albeit only a 35% payout ratio of eFCF - assuming they up this to a 50% next year would mean a 6.45% dividend yield.

I also think there's a chance of a reverse stock split as well as the launching of a share buyback. The blue-sky option is they decide to pay out 75%+ of eFCF as a fully-franked dividend which means a dividend yield of 9.5% - 13% which would likely lead the stock to immediately double.

On top of that, you have the optionality from:

More large Global deals announced (highly likely given a very pedigreed Head of Sales has just been announced for Global - he was 16 years at Tata Comms: https://www.linkedin.com/in/patrick-simon-5689b0/)

The interested bidders from last financial years strategic review re-approaching the business)

Accretive M&A

Liquidity is limited here, but the market is over-looking the very high run-rate equity free cash flow generation of the business, and the optionality from the Global segments.

Thank you for reading,

Amadeus

You can actually find questions from BFF on the ECB FAQ page when the new default definition was being introduced where they raise the question of contagion. One solution for them is to apply for the IRB models for PD, LGD and ELBE and thus avoid in future a 150% RW for underprovisioned NPLs (with less than 20% provisions). But this can take years, usually a year or so to develop a model, quarter to validate it internally and then a year or few to get it accepted from the regulator. Better solution for them is to better manage Italian NHS exposure and to prevent sequential days past due cumulating under the same roof facility.

Can you walk through how you derived the excess land values? Typically I've seen Japanese companies report the asset base including book value of properties, land sqm, etc. A few questions though:

- They don't normally give the split between operational PP&E vs. rental PP&E on the breakdown in assets?

- How are you finding the specific address of the owned buildings to compare to Tochidai?

- How are you estimating the excess land value vs. how much is used in operations?